The air in Davos, Switzerland was cold, but the forum's slogan was warmer and more idealistic than ever. The 2026 World Economic Forum (WEF) proclaimed "Spirit of Dialogue" as its main theme to heal an increasingly fragmented world.

The organizers ambitiously presented five core agendas—cooperation in a divided world, discovering new growth engines, responsible AI innovation, investment in human resources, and prosperity considering climate and nature—appealing for global cooperation. However, when the curtain was lifted at Davos, this spirit of 'dialogue' and 'cooperation' became hollow echoes before America's overwhelming logic of power.

Instead of cooperation, nationalism prevailed; instead of responsible regulation, technological hegemony dominated; and instead of climate-conscious prosperity, President Donald Trump's declaration dismissing green energy as a "scam" dominated the agenda. The 2026 Davos Forum merely served as a platform declaring that AI and blockchain are no longer blueprints for humanity's common prosperity, but rather 'economic infrastructure' and weapons led by the United States.

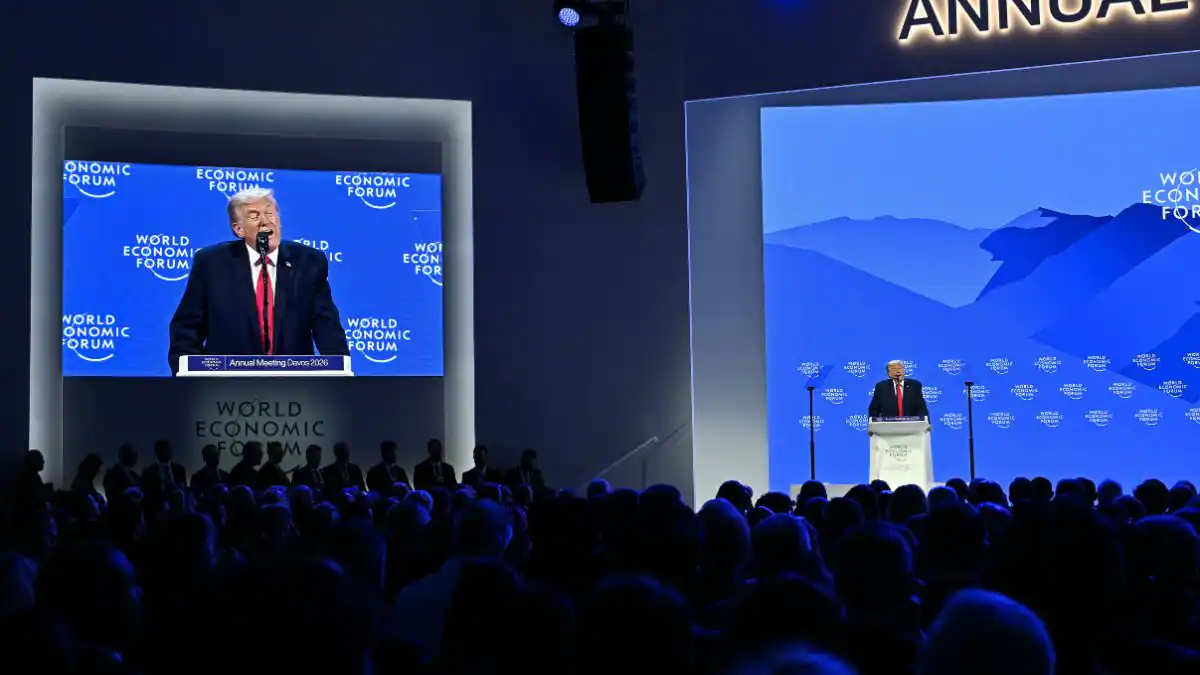

Two symbolic moments reveal the true nature of this forum—the absence of 'dialogue' replaced by America's overwhelming confidence. One was President Trump's roar ridiculing European policies, declaring "the American economy is the hottest in history." The other was Bermuda, an island nation of 60,000 people, deciding to transfer its entire national economic system to American companies' (Circle and Coinbase) blockchain technology. This was definitive proof that 'new growth engines' ultimately meant 'Americanization.'

The Bermuda Experiment: 'Americanization' of National Systems

First, we must focus on Bermuda's announcement. This isn't simply about buying coffee with Bitcoin. The Bermuda government decided to process all national economic activities—from tax payments to utility bills and daily transactions—using Circle's USDC, outsourcing the construction of the underlying financial infrastructure (back-end) to Coinbase.

This has profound implications. It means an American private company is building a nation's 'financial operating system (OS).' If in the past America dominated global finance through the dollar currency, now it is 'platformizing' and controlling other nations' economic systems themselves through stablecoins and exchange infrastructure. This reads as a sophisticated strategy for expanding digital asset hegemony through private companies without direct government intervention.

Trump's 'Magic': Meeting of Deregulation and Infrastructure

This private sector expansion precisely aligns with the Trump administration's policy direction. Standing at the Davos podium, President Trump called the Biden administration era a 'stagflation nightmare,' asserting that deregulation and tax cuts during his term led to record-high stock markets and inflation control.

Particularly striking was his fierce criticism of Europe's green energy policies as "the biggest scam in history (Green New Scam)." This declaration prioritizes efficiency and pragmatism, indirectly signaling that America will provide a favorable environment for energy-intensive AI and cryptocurrency mining industries. As the U.S. removes regulatory uncertainty through the 'Clarity Act,' Wall Street capital and Silicon Valley technology are explosively combining.

The Institutional Era: From 'When Will It Come' to 'How Will We Use It'

At the 2026 Davos Forum, cryptocurrency was no longer treated as a 'risky speculative asset.' Instead, it wore the badge of 'Modernization of Finance.' The 'Institutional Era' has officially begun, where traditional finance (TradFi) and decentralized finance (DeFi) combine to tokenize assets (RWA) and revolutionize cross-border payments, rather than one consuming the other.

As Ripple CEO Brad Garlinghouse mentioned, market attention now transcends simple price fluctuations. Substantive discussions centered on how central banks and institutions will utilize stablecoins and how blockchain will replace the aging SWIFT network.

Conclusion: The Dawn of a New American-Led Order

The 'Spirit of Dialogue' proclaimed by the 2026 Davos Forum was hollow. What filled that void was 'America's Digital Financial Hegemony Declaration' armed with cryptocurrency. This forum confirmed that blockchain has completed its technological experimentation phase and 'perfectly settled' as national-level infrastructure within an American-designed order.

Bermuda's 'national economic on-chain transformation' is merely the prelude. This model—where American companies (Circle, Coinbase) replace other nations' economic bloodstreams—suggests that Trump's 'America First' is expanding beyond manufacturing and trade to 'monopoly of digital financial infrastructure.' A new dependency structure is being created where the entire world can only run on American-laid rails.

We are now witnessing not merely cryptocurrency market volatility, but 'the digital evolution of dollar hegemony.' Where speculative frenzy has passed, a solid 'digital financial highway' with the giant American flag planted is being paved. A new era has arrived where other nations have no choice but to pay the toll to navigate it, abiding by American rules.

'Great Opening' 카테고리의 다른 글

| Musk's Vision of Humanity's Future and the True Path to Survival (0) | 2026.01.25 |

|---|---|

| Day 2: Understanding the pattern of time (0) | 2026.01.12 |

| Day 1: The Fever Dream We're All Living (0) | 2026.01.12 |