The Inevitable Unwinding: Why the Yen Carry Trade Is a Ticking Time Bomb in Global Finance

How Japan's ultra-low interest rates have silently shaped global risk—and why the reckoning may be near

In a world increasingly dominated by complex financial instruments and capital flows, few mechanisms have been as quietly influential and systemically risky as the yen carry trade. Rooted in Japan's long-standing ultra-low interest rate policy, this strategy involves borrowing yen at near-zero cost and converting it into higher-yielding assets in other currencies. On the surface, it appears to be a harmless arbitrage opportunity. In reality, it represents a critical fault line embedded deep within the global financial system.

According to Deutsche Bank, the yen carry trade may account for more than $20 trillion in global positions, equivalent to approximately 27 quadrillion Korean won.[1] These trades are not confined to hedge funds or global asset managers; Japanese banks, insurers, pension funds, and retail investors worldwide also participate in this yield-hunting strategy. What renders this structure fragile is its dependence on stable conditions. The entire mechanism functions smoothly—until it doesn’t. To put it simply, the yen carry trade is like borrowing cheap money in Japan to chase higher returns abroad. But when conditions shift, that easy money becomes a financial trap.

The real risk lies in the unwinding. Any abrupt shift in Japan’s monetary policy—such as a sudden interest rate hike—or an unforeseen national disaster like a Nankai Trough earthquake could trigger a massive unwinding of yen-denominated positions. This would spike demand for the yen, causing its value to surge. A stronger yen raises the cost of repaying borrowed positions, which could lead to mass liquidation of foreign assets and sharp declines in global equity and bond markets.

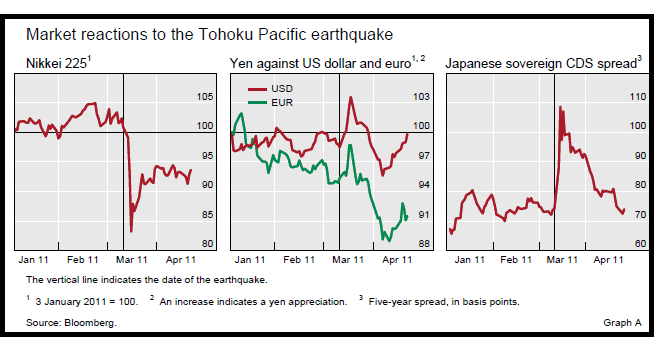

This scenario is not hypothetical. History has revealed early warnings of this risk. During the 2011 Tohoku earthquake, G7 nations coordinated to stabilize the yen as Japanese investors repatriated capital. But in 2025, the global environment may be far less cooperative. Sovereign debt levels are at historic highs. Major economies are tilting toward stagflation. The United States, amid rising political polarization and a shift toward protectionist trade policies, may be less inclined to lead or support coordinated interventions.

Moreover, Japan’s national debt has surpassed 260% of GDP,[2] making even modest interest rate increases a significant fiscal burden. If the Japanese government must repatriate capital en masse to fund disaster recovery or economic relief, the ripple effects could be severe. Unlike in previous decades, today’s financial ecosystem is more fragile, more fragmented, and more heavily leveraged—ill-equipped to absorb such a shock.

The yen carry trade is no longer merely a technical strategy; it has become a systemic risk factor. While its collapse may not be imminent, its inevitability grows with every incremental rate hike, geopolitical disruption, or seismic event—as well as rising probabilities of unforeseen shocks, including major natural disasters or emerging global pandemics.

As history demonstrates, financial systems tend to be most vulnerable not during visible crises, but in moments of transition—when long-held assumptions unravel quietly and liquidity evaporates before anyone notices.

Now is the time to build resilience—not just through temporary measures, but by recognizing that the root of today’s crises lies in long-accumulated structural issues. These are not isolated issues, but symptoms of a global system nearing its limits. Without a fundamental shift in how we understand and manage economic systems, no patchwork solution will hold. When the yen tide finally turns, like a tsunami set off by a deep tectonic shift, the shock will extend far beyond Japan, shaking the foundations of a fragile global economy.

References

[1] Deutsche Bank Report on Global Currency Flows and Carry Trade Exposure, 2022.

[2] IMF Fiscal Monitor, October 2023: Japan's General Government Gross Debt to GDP Ratio.

[3] The Picture 3: https://www.bis.org/publ/qtrpdf/r_qt1106u.htm